Through your gift, you can provide personalized, life-changing care to every child and adult who comes through our doors — regardless of their ability to pay. What’s more, you can enjoy tax benefits from these gifts now, or you can establish a future gift that will pass tax benefits along to your loved ones.

You can learn more about these special opportunities in our free brochure, Tax-Wise to Make an Impact, and other complimentary planning resources.

These resources are just a click away!

Stocks and Securities

When you give stock or securities (stock, bonds, mutual funds), you may be eligible for a double tax benefit: 1) You receive an income tax deduction for the full, present, fair market value of the assets, and 2) you may completely avoid capital gains tax on the appreciation of the assets. This is one of the easiest gifts to give and one of the most useful in accomplishing your philanthropic goals.

Retirement Assets

A gift of your retirement assets, such as an employee retirement plan, IRA, or tax-sheltered annuity, is an excellent way to make a gift. A gift of these assets can shield you or your heirs from taxes while funding National Jewish Health.

Life Insurance

Transfer ownership now:

To make an impact on the lives of our patients, irrevocably designate National Jewish Health as owner and beneficiary of an existing life insurance policy. If your policy is paid up, you will receive an immediate income tax deduction based on the policy value.

If your policy is not yet paid up, you will make contributions of cash to National Jewish Health to cover future premium payments. For any continuing premium payments you make, you will receive a charitable deduction in the year of the payment.

Name us as a beneficiary:

You can name National Jewish Health as a beneficiary of all or a portion of your life insurance policy. With this gift arrangement, National Jewish Health will receive the proceeds of your policy when you pass away. You can change your beneficiary at any time.

This gift is easy to arrange — simply request a beneficiary designation form from your plan administrator.

Personal Property

A gift of artwork, coins, antiques, or other personal property can be an excellent way to support National Jewish Health. The tax benefits of the gift depend on whether National Jewish Health can use the property in a way that is related to its mission. Contact us to learn more about this type of gift — we would be happy to help you find the option that best fits your philanthropic goals.

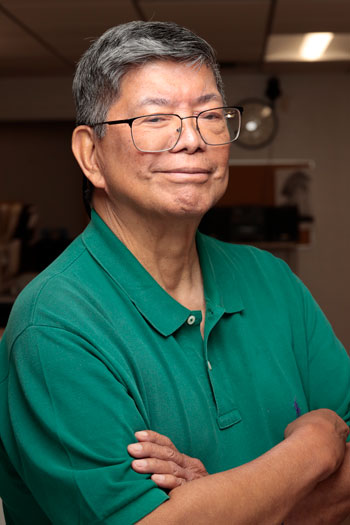

From a Supporter Like You

Ned is a chemical engineer who spent a week at National Jewish Health in the early 1990s and found answers to the asthma attacks that used to prevent him from working. Now, in appreciation of the life-changing care he received, Ned has been donating monthly but has chosen a charitable gift annuity as a way to save on taxes.

“I wanted something safer as I neared retirement,” said Ned. “A charitable gift annuity with National Jewish Health offered guaranteed payouts for life that are mostly tax free.”

Our Team is Here to Help

Our experienced team is here to help you…

- Learn about special projects that align with your interests.

- Structure a donation that maximizes benefits for you and your loved ones.

- Stay up to date on how your gift is used.